What are Blockchain-Based Smart Contracts?

The rapid growth of blockchain technology and cryptocurrencies has altered the financial industry

+44-7511-112566

+44-7511-112566

+353-1-8079571

+353-1-8079571

+1-415-799-9792

+1-415-799-9792

+44-7511-112566

+44-7511-112566

+353-1-8079571

+353-1-8079571

+1-415-799-9792

+1-415-799-9792

The rapid growth of blockchain technology and cryptocurrencies has altered the financial industry

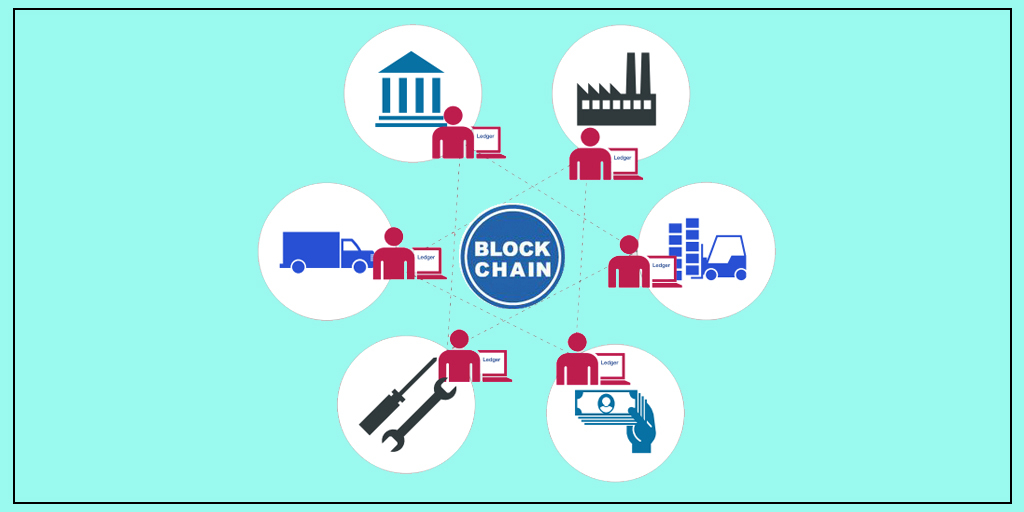

Blockchain technology has been accompanied by a lot of hype, which has attracted the interest of many corporate

Do you think Blockchain and Distributed Ledger Technology (DLT) are the same? No.

Since its introduction, blockchain technology has gained significant attention due to its unique immutability,

Despite this massive investment in cybersecurity, cybercriminals continue to attack known

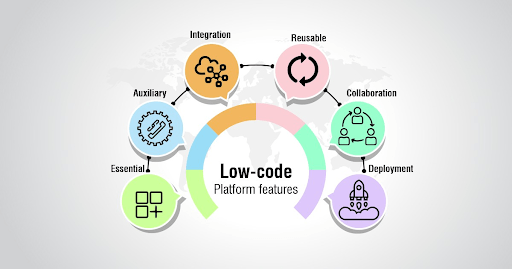

As the world progresses towards extremely transparent and highly robust

Since the creation of the first public blockchain to allow bitcoin transactions, blockchain technology

Blockchain technology seems to be picking up speed these days.

Blockchain vs Database has become a hot topic for debate amongst the tech world

From an extremely humble beginning in 2018, with 0.28 bn USD market size in 2018,